Commercial -owned real estate set off a new tide -buying asset operation capacity to win and defeat

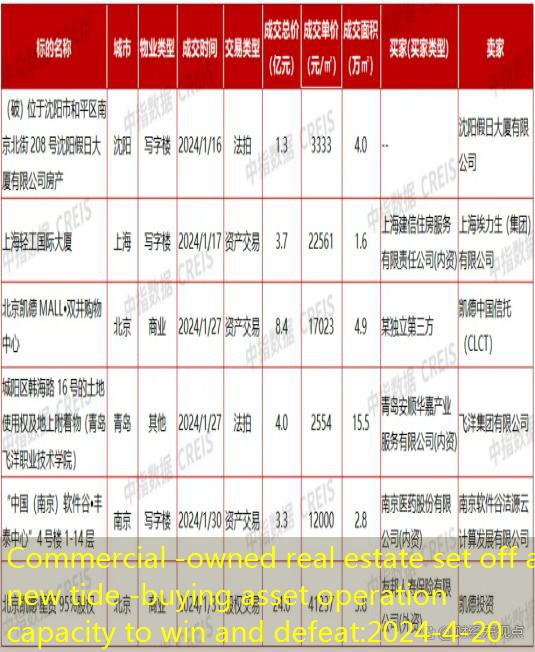

Zhonghong.com, Beijing, April 15th Although the domestic real estate industry is still adjusted at the bottom, the latest data shows that as soon as the first quarter ended, the commercial real estate transactions were active. In January, there were 6 large transactions with a turnover of over 100 million, with a total transaction price of 4.47 billion yuan.EssenceThe Internet manufacturer started land resources. In January of this year, Tencent won the road plot of the Hailian District College, with a transaction price of 6.42 billion yuan, and the funds continued to focus on the unimplained production of high -level cities.

Insurance and capital fascination opportunities, the group snap -up boom is lifted

In this new round of commercial assets, insurance capital has become an important purchase power that cannot be ignored.Since March 2023, the Shanghai Stock Exchange has issued policies to encourage qualified insurance asset management companies to launch ABS and REITS business, and many insurance asset management companies have launched pilots to further promote insurance capital to participate in real estate investment.

According to data disclosed by the China Insurance Industry Association, many insurance companies such as Ping An Life, Taikang Life Insurance, AIA Life Insurance, Tai Baoshou Insurance, China Post Life, CCB Life, Haibao Life Insurance have disclosed large real estate investment announcements, mainly involving commercial office officeReal estate, industrial parks, real estate and self -use pension communities real estate projects.

Data source: middle Finger Research Institute, Beijing Municipal Planning and Natural Resources Committee website

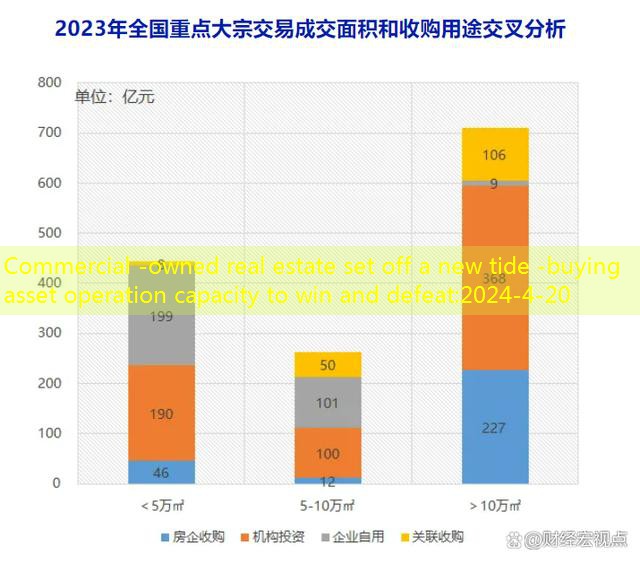

From the perspective of acquisition purposes, the investment attributes of large acquisition of property are prominent.In 2023, institutional investment transactions reached 65.7 billion yuan, of which top enterprises such as Kaed Investment, Ping An Life, AIA, and Zhongyou Life Life won the amount of one billion yuan, such as 7.3 billion, 3.2 billion, and 4.3 billion.Multiple assets, high -quality assets are hot at the market for a while.

Behind the active real estate transaction is the improvement of business data.According to Winshang big data, in 2023, the average vacancy rate of the national key 24 city shopping centers nationwide was 9.06%, a decrease of nearly 2 percentage points from 2022.It can be seen that after the vacancy rate reached the high point in 2020, the overall business rental rate continued to improve; after 4 years, the vacancy rate returned below 10%.

For the purpose of long -term holding, many institutional investors seize the opportunity window period of high -quality commercial real estate project investment, and quietly cultivate in advance for the market recovery.

Data source: 58 Zhilou

S three to build an asset value system, and the interests of investors in all -round escort investors

”In the environment of the 28th division of commercial properties, in the environment of rising vacancy rates, high -quality business -run properties will rise against the trend.” Xiang Xinxin, director of the research director of Zhonghong Digital City, believes that investment customers who invest in commercialized investment are basically believed that investment is continuous.The process of sexual discovery value is a long -term holding process for high -quality assets; then while investing customers are required to pay attention to the macroeconomic situation, they also need to have a keen market insight, and the property holders are rich in the property holder to be rich in rich.Industry experience and mature asset operation system.Xiang Xinxin believes that in this regard, Longhu took a lead.

As one of the leading companies in the domestic commercial TOP5, Longhu Group has established a mature system for how to judge the changes and opportunities of the market.It is understood that Longhu can be based on 33 high -energy cities across the country to rating the industrial energy level and model model, combined with local industrial and housing prices, industrial and market health analysis, and find the most delineated value depression in the city.EssenceBehind this, Longhu Group relies on the camp project and digital base to build a large set of customized database data, which is based on the steady stream of data as the basis for judgment.It is reported that in the past five years, this database has dynamically collected key information of 7,198 sectors in 61 cities, forming a 3,000 -month project -level monitoring data, and 7.36 million fields that can be used as an investment basis.

Correspondingly, Longhu sales assets also generally maintain a good leasing rate and asset yield.In Chengdu, the original works of Xizhen, Ziyu, Jiuli Qingchuan, Listening Blue Bay, Listening Lan Time, Three Three Thousand Tings, etc. of Longhu’s commercial street business rental rates have exceeded 70%, and the return on investment is above 6%; Among them,The return on investment in Ziyu and the three thousand court projects reached 7.4%.This number means that it only takes more than 10 years, and the investors can recover all investment in investment.

As we all know, the maturity of a regional sector needs to be measured from multiple dimensions such as the entry of enterprises, industrial investment, business atmosphere, consumption power, and popularity.accomplish.The increase in the value of Longhu commercial assets is also inseparable from its systematic system support.

Taking Nanjing · Long Hubei Constellation as an example, its own geographical conditions are superior. It is located in the industry and residential center of the direct management area of Nanjing Jiangbei New District, Nanjing New District.The atmosphere is strong, and it is connected with 150,000 square meters of Jiangbei Tianjie. The total construction area is 113,000 cubic meters, and the commercial format is fully covered.The Beichen constellation changed the local life consumption method in the subtle way. Before work, take a glass of Ruixing and eat a fellow chicken at noon.It is a 20 -square -meter exquisite drink, or a hot pot meal of hundreds of square meters. You can quickly find a suitable matching method with your spare time. With a stable operation, Nanjing · Bei Constellation increased by 14% compared with the end of the year at the end of the year.Essence

Nanjing · Long Hubei Constellation

It is understood that for more than 30 years, Longhu Group has formed a “one Longhu” ecosystem for the coordinated development of the three major business segments of development, operations, and serving the three major business segments.Among them, 1 development channel: real estate development; 2 operating channels: commercial investment, asset management; 2 service channels: property management, smart construction.

With the maturity of the various businesses of Longhu, they are all among the TOP10 echelons in the industry. The convenience and drainage effects brought by business, the population foundation of the sector corresponding to the residential apartment, etc. Different scenarios have begun to amplify in collaborative utility.Public data shows that many Longhu sales commercial platinum island products are accompanied by shopping malls.Between 4.8%-7.4%, the rental rate also reaches more than 70%; in addition, some newly launched sales-based commercial projects in Longhu are also part of the huge complex, such as Longhu Guangnian in Shapingba, Chongqing, and Jiangning Binjiang, Hefei.Urban projects, including Platinum Island in Nanjing Jiangbei, Beichen Constellation in the High -tech Zone, and other shops and office projects, they are connected to Tianjie and adjacent to it to ensure that the location is always at the core of the business district, and sharing the convenience and influence of the shopping mall.

In addition, Longhu has deployed a full -process business ecosystem to build a comprehensive commercial product value system: For the development enterprise itself, Longhu, as the only real estate company in the industry in the industry.There are 400 cooperative brands and have comprehensive merchant cooperation resources; for sales -oriented business, Longhu has launched a full set of equity solutions for the neighborhood strategic alliance merchants., Unicom’s full -cycle asset management and omni -channel linkage promotion; from the perspective of business operations, Longhu provides smart services, store recruitment planning services, air -conditioning machine planning, shop decoration collaboration, regular training, etc., multi -channel linkage promotion, Longhu self -media mediaMatrix, grafting Longhu cooperation with external media resources, has opened a new starting point for smart operations.